Barcelona’s municipal authorities are seriously considering revising the city’s property tax system. On the table is the possibility of introducing a progressive scale for owners who possess more than one apartment. If successful, this step could make Barcelona the first in Spain to implement such a change, provided modifications to national legislation are secured.

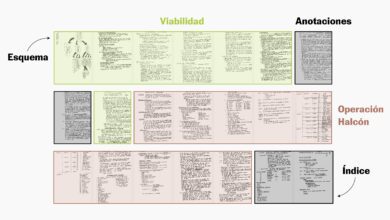

The core idea of the initiative is to directly link the amount of property tax (IBI) to the number of properties owned by one individual. The more apartments you own, the higher the tax rate. Currently, this tax is the main source of the city’s budget revenue, and any changes to its structure require thorough legal and economic analysis.

The issue of reform was raised during negotiations between the city administration and the political parties supporting the current mayor. The agreement reached not only calls for analyzing the feasibility of a progressive property tax, but also for preparing a formal request to the Ministry of Finance to amend the existing law on local budgets.

Additional changes in tax policy

Alongside the discussion of a progressive scale, Barcelona’s authorities are also considering other measures. In particular, they plan to examine whether tax benefits can be equalized for single-parent families and large families. Another initiative aims to enshrine in city regulations the prohibition against passing the tax burden onto tenants—a rule already outlined in the national housing law.

Particular attention is also being paid to the hotel industry. For hotels with a high cadastral value, especially luxury-class ones, the tax rate will be increased. Over the next two years, it could rise to 1.3%, which will be a significant blow to luxury hotel owners. This is linked to the fact that, for several years now, there has been a ban on building new hotels in the city’s central districts.

Urban environment and support for residents

The agreement also includes measures aimed at improving the urban environment. The authorities plan to restrict the opening of shops aimed exclusively at tourists in several districts. This is intended to help maintain a balance between the interests of locals and the tourism sector. Additional funding will be allocated to update infrastructure in neighborhoods in need of support, such as Besòs.

At this stage, all these initiatives are still under discussion and require approval at the national level. However, it is already clear that Barcelona is prepared for major changes in taxation and urban property management. If the reforms go ahead, they could set an example for other cities in the country.